What we were discussing is a different topic, you are moving the goalpost with this message.

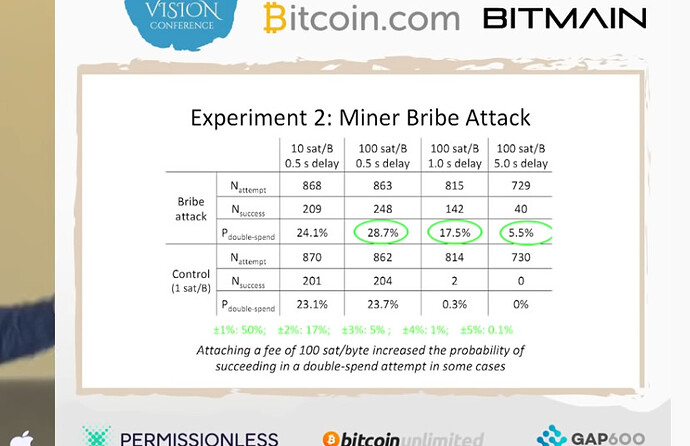

The discussion was about your CHIP proposing a second way to make instant transactions secure, while we already have one which is active and operational. My question has always been about the business case. Why do you want the ecosystem to invest resources into this while there is a fully functional solution available that addresses the same problem. The business question is relevant because we have actual empircal data showing that the merchants don’t have a need to decrease zero-conf risk.

To put it in simple terms; you are asking everyone to put a lot of effort into a new virus killer for Linux, while all previous virus killers for Linux failed to get a userbase due to lack of interest.

It is not my job to push back, it is yours to convince the community that this is actually something they need to put time in.

Which reads:

For many businesses, assessing the risk of payment fraud against zero-confirmation BCH transactions is non-trivial.

This is mostly due to the point-of-sale software not incorporating double spend proofs. The rest is available, the support in the full nodes, the support in servers like Fulcrum. A point-of-sale software (should it be available open source) is not hard to adjust and this problem goes away.

Notice that incorporation of ZCE likewise needs adjustment of that exact same software. You may argue it is somehow a different workload, but as we are for both jobs talking about less than a week of work I have to ask why you are not advocating using of what is available on mainchain today. If for no other reason than speeding up the security of zero-conf.

In a previous post I probably was not clear, so I’ll say it plain.

Your “long term security” concern is based on a misunderstanding of how the p2p network operates and who secures the first seen rule. The result is that your point is not applicable to Bitcoin Cash and that section and that reason should be removed from the CHIP.

The first-seen rule is secured by the nodes on the edge, the ones that the SPV wallets actually talk to. Miners hide their nodes behind firewalls (because duh) and they are never going to even see double spend transactions. Should a miner implement replace-by-fee, it would have no effect.

First-seen is secured by the companies that depend on it working, not the miners.

Can you please update the CHIP to reflect those two points?

- Provide a business case explaining from the current state of mainnet which has zero-conf security.

- update (and likely remove) the long term security chapter.