This brings to mind the very insightful story of the technical guy that did marketing, he explained all that was awesome about his product and, as he is technical, noticed the problems in his explaining of how awesome the product is. He added that in the next release those issues will be fixed, however. It could be easy to overlook the fact that the product was indeed by far the best on the market.

The predictable result was that the people didn’t buy the product. Only very few got sold because the would-be customers ended up waiting for the next release. The end result is that the company went bankrupt.

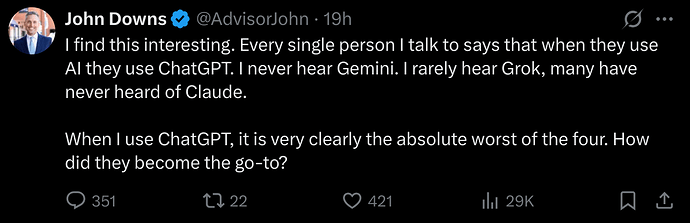

The story illustrates that product quality and market share are not at all the same thing.

Being the best doesn’t lead you to be ‘market leader’. And vice-versa.

This is all a long explanation of how Jeremy is utterly wrong about the above quoted conclusion. In a very dangerous and destructive way!

The way to get Bitcoin Cash marketshare to increase is based on first determining what your market is (how do you measure market share). Do you want to optimize for high price, or for lots of people using it as cash?

Most important step here is to realize that Bitcoin Cash is already actually technically superior over the vast majority of its competition. Which, as soon as you accept that, leads to the obvious question: but why are we not leading in those measurements we set ourselves as goal? In other words, why are we not market leaders?

This is when you really can get stuff moving, realizing that the product as is (the coin, the consensus rules, the community) is healthy and strong.

Then we can move to try to sell it to real people. Find out what needs work. Block waiting time is obviousy an annoyance, but not having repeat payments is a bigger one. Not having a 1000 different features that the banking system offers companies and users today are really quite a big more important to the sales-pitch than sometimes needing to wait.

Because at the end of the day, the competition is what people use already. Which is the banking system using fiat. Which is the products the banks and card companies ship. The apple pay / google pay / 𝕏 pay. What do they have which the bitcoin cash experience lacks? Can that work be done in services and wallets? Or does it REALLY need to be the coin that is changing?

The focus on “changing the coin” is misguided. The product is easily better than most (all) of the competition. If you don’t believe that, what on earth are you doing here?

If you DO believe that, go out and sell it. Go out and improve the wallets and the services to be able to do what people expect from a financial system.

Stop trying to push technical debt into the core of the coin because you think that helps you sell it easier. That’s just lazy.

ps. as an aside, the term “market leader” derives it’s name from the leader being the first. Not the most successful. The market leader is very often the first to market and gains the most as a result. Dictating the market as a whole.

This also answers why market leaders are actually quite often NOT the technical best. Are often not the ones with the most features.

This further illustrating the point in bold at the top of my post.