On revival of this old topic I want to update it with some thoughts;

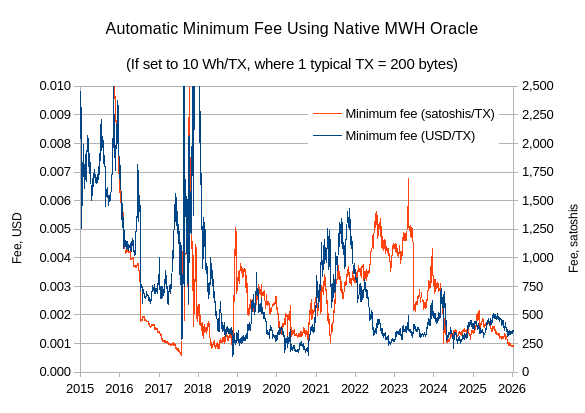

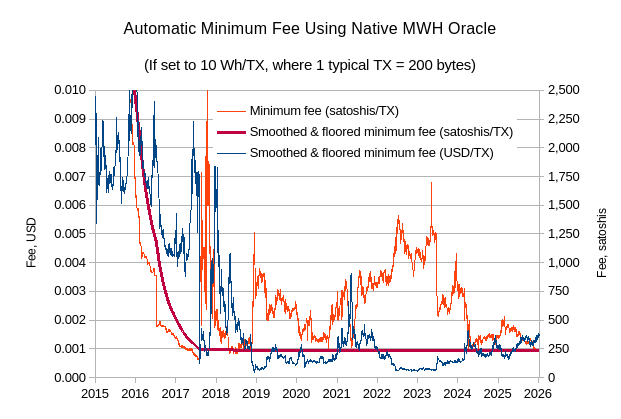

first, the default relay fee is indeed a long term real problem. Should the price of BCH go up a lot, we can see 1 dollar fees or more. And the fees can’t be lowered by miners because the nodes in the middle simply block all reasonably paying transactions.

So I’m in full agreement that they should be very significantly lowered at one point.

The main reason it was introduced was always explained as a spam protection, and that was a sane protection since we’ve seen a lot of bad stuff being thrown at our coin over the years. But mostly this attack has not happened. It would not be too expensive to mine a bunch of 32MB blocks full with your own transactions, but no miner ever did. No group ever did such an attack of lots of big blocks. Thank $DEITY.

That does not mean we should drop the relay fee directly and completely, just making the case that our behavior should be based on long term goals and not just simply continuing the road of min-fee we started out of (realistic!) fear.

So to me the goal of mining and minimum fee is that we avoid the debate and we avoid the always problematic design by committee that comes with any sort of central pricing design. The goal instead is to make the prices be set by miners by them simply not mining when they don’t get paid enough. Which may mean they only include high fee paying transactions, or if there are not enough fee paying transactions they may simply decide to not mine Bitcoin Cash. This last part is a reality today. Miners are known to only mine if the electricity in their area is low price. Rainy season for water-power generated electricity as a good example. Winter in areas where the cold allows them to not pay so much for cooling systems, as a second example.

It is a well understood idea because it aligns with the free market. Miners choose to mine when they get paid enough to make the work worth it. And this will shift towards fees over the next decade(s) while the block reward diminishes. Miners will set the price. An idea that works in all industries in free economic systems. They will simply demand a certain income before they do the work. Too low pay, no blocks being mined. Or if we get the tools to do something more fine grained; your low fee paying transaction is ignored in the blocks that are being mined. So pay a reasonable fee and help that miner earn a living.

The free market solves the price setting without any need for an algorithm. Open any economics book, especially from Austrian economics authors, and this is explained repeatedly.

In short, I think we do need action on the minimum relay fee. It needs to be actions with the goal that moves the long term setting of the fee by the market. Supply and demand. Where the ones doing the mining actively eat the supply of transactions that need double spend protection. A free market does not work when some central property distorts it by setting a minimum fee that needs to be charged by miners. So the goal of having a free market of fees means that BCHN needs to severely lower or even remove the relay fee over the next 10 years.