Where is the documentation/research behind your claims?

Here you go, have a good read:

Ethereum started with PoW and had MEV. Now PoS is implemented and still has MEV.

Yet it was always EVM. Not UXTO.

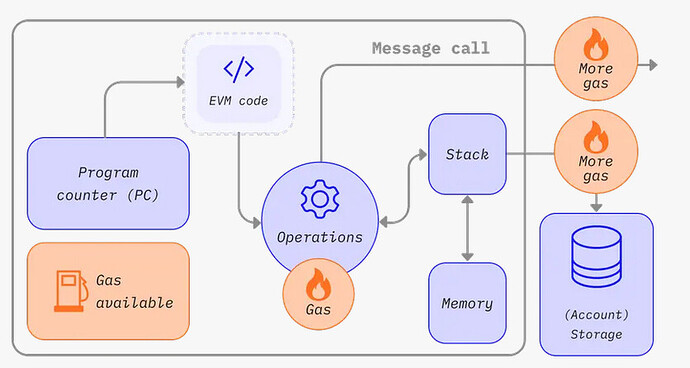

Here, check out this easier to understand diagram, since whitepaper could be too much for you:

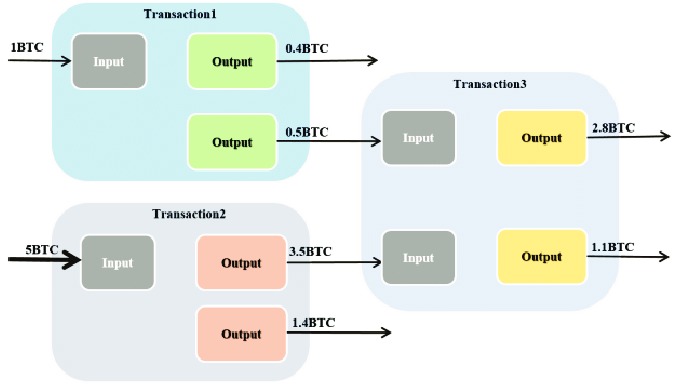

For comparison, here is the UXTO model.

See any similarities? No? Because there are NONE. Ethereum is to BCH like Knife is to a Chainsaw.

You can probably cut bread with a chainsaw, but it will not be very effective.

Same with trees. Easy to cut with a chainsaw, not so easy to cut with a knife.

Plenty of MEV on Cardano that has the UTXO model. This is not rocket science.

Just stating the obvious. Why don’t you explain why there is plenty of MEV on Cardano that has the UTXO model? Does that fact not fit into your demagoguery?

Linking to data is not research? I’m done communicating with you.

Without any context or explanation, it is not.

I am unflagging. Shadow is right that you need to put more effort into explaining what you want to say in a cohesive way, not just putting a list of links. However, he is also clearly inappropriate in the additional accusations / things that he said.

Please add that explanation to the original post.

I have also hidden a whole swath of irrelevant insults and accusations. A few valid points were lost in those comments, but so be it. I recommend people learn to respond to relevant points while ignoring the irrelevant / inappropriate parts. The flagging system can help with the inappropriate stuff instead of dragging the conversation down.

Not applicable to us, UTXO/Script just doesn’t work like this:

Searchers can afford to hammer every block with speculative transactions knowing that the profit from a single success will cover the cost of many, many failures.

Yes, not everything is applicable. Don’t let that stop you from reading it.

This report is interesting because it highlights the level of MEV spam that will happen if DeFi is successful on Bitcoin Cash. If we implement Avalanche Pre-Consensus before MEV tools are developed, we will still see spam hitting the network, but this spam will pay the min relay fee and help push DeFi pools to correct market prices. If we don’t implement Avalanche Pre-Consensus this spam will be included as zero fee paying transactions by the miners, most likely also nuking unconfirmed transaction chains. With Avalanche Pre-Consensus we will have the public mempool perfectly in sync, but without it there will be many dark transactions in new blocks.

No it doesn’t. None of that applies on UTXO architecture. The only thing that link and your comment shows is that you’re just a low-effort Avalanche salesman incapable of any technical understanding. You’re just sticking words together as if everyone else is dumb, it’s insulting.

Markets moving and anyone-can-spend UTXO sitting on the blockchain will generate opportunities for trades. That this blog post is mostly about spam transactions that fail, is not an argument against that fact. This community is in for a rude awakening if it continues to disregard that MEV can happen with the UTXO architecture as well.

[Technical Proof Needed] [Merit needed]

This is not really going anywhere. You are never going to convince anybody here without actual arguments.

AI slop and making AI do the thinking for you is not going to ever, ever work.

It would be advisable to give up, before everybody in the BCH starts hating you with vengeance for spamming various forums with non-argumentative AI filler.

Conclusion of the paper, since for some reason you did not explain what this means:

7 Conclusion

As trading migrates fully on-chain across multiple networks, cross-

chain arbitrage is poised to become DeFi’s primary mechanism

for keeping prices aligned across chains. We examine this mecha-

nism with a profit–cost model contrasting inventory- and bridge-

based execution, and with a year-long measurement across nine

blockchains. The model pinpoints opportunity frequency, bridge

time, and token depreciation as the key profitability drivers; empir-

ically, daily volume grew 5.5× over the study window and spiked

after Ethereum’s Dencun upgrade. Yet bridges still impose a siz-

able latency cost: 66.96 % of arbitrages use inventory and settle

in 9 s, whereas bridge trades take 242 s. Activity is concentrated

as well—five addresses generate over half of all trades, and one

captures nearly 40 % of daily volume post-Dencun. Because this

MEV stream rewards vertical integration between searchers and

infrastructure operators such as sequencers or staking providers, it

risks centralizing sequencing infrastructure and economic power,

amplifying censorship, liveness, and finality threats. Decentralizing

block building and lowering entry barriers—thereby undercutting

exclusive sequencer–searcher deals—are critical countermeasures.

We hope these findings inform designs that curb such risks as the

ecosystem advances into an ever more multi-chain future.

This is not related to any kind of UXTO chain mechanic.

The paper clearly explains issues that can arise in multi-blockchain (linked) systems that work on Ethereum-like virtual machines and proof of stake incentive scheme.

The infrastructure and technology mentioned in the paper is completely unlinked to anything resembling UXTO DEX markets.

Therefore I find this paper redundant and not adding anything to the discussion.

In Bitcoin Cash we try to take the values and priciples from the open source world, as you can see with our open research right here.

Another thing that is taken from FOSS is the idea of meritocrazy. We care not about who or why a contribution comes in, we care only about the quality of the contribution.

You clearly have bought into some ideas, which is nice, but your posts here are lacking merit. They are sales pitches at best. They are asking others to do the work, somehow assuming that if you ask enough we’ll reach another conclusion.

But there is zero reason given for a technical person to change their minds. We don’t change our minds just because some people really want us to. No, meritocrazy is about actual contributions. And suggesting OTHERs do the work is not a contribution.

+1337

The mere concept that I should change my mind just because somebody wants me to is highly insulting to me as a technically-oriented person.

The only way to convince me is to provide proof that MeV problems on BCH can actually exist AND that Avalanche works in practice.

It would seem that neither exists, so the easy conclusion here is that Avalanche should simply never be implemented, no matter how much and how loud some people insist on it.

Again, the concept that something should be done because someone shouts very loud about it is disgusting, insulting to the intellect and abhorring.

EDIT/PS.

Essentially, at this point, implementing Avalanche would be equivalent to openly sabotaging the Bitcoin Cash project.