On BCH-Native Wallets and App Stacks

The Bitcoin Cash ecosystem is at an interesting place in history. We are about to graduate from simple “send/receive” and start to realize the full power of Bitcoin Script / Virtual Machine that was there from the beginning.

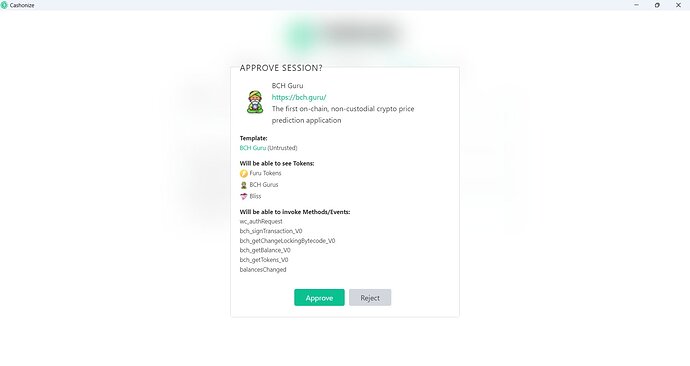

Everybody has different priorities on what needs to happen next, but one specific outcome is that we will certainly end up with one or more native bch wallets plus one or more native app stacks that can that can handle every possible bch transaction. The switch from “send/receive” to bch-native is a simple concept with deep complexities.

Translated: we have a mountain of work to do.

A Suggestion about How to Approach the Situation

Standards for BCH-native wallet and apps are going to emerge one way or another. I suggest that:

- Nobody has “the answer” at this point - we still need a lot of experimentation.

- The long term goal is truly excellent, massive-scale, world-class solutions. Something to keep in mind as we build up from the foundation.

- Design by committee doesn’t work, and design in complete isolation doesn’t work. The incentives of the BCH network give us alignment that we can leverage to find a sweet spot in that spectrum.

- A conscious effort to communicate along the way increases low-key friction in the form of early constructive debate, and critically reduces the potential for acrimonious sunk-cost contention later on.

- Having a somewhat cohesive state of things will make BCH ecosystem look more attractive to entrepreneurs and builders considering jumping in.

The current “BCH Devs and Builders” group may be good for this discussion. I’ve also made a focused group “Native BCH Wallets and Apps”" in case that turns out to be a better way.

1 BCH for Design Documents to Get Started

To get things started and to show that this is more than spouting ideas, I am offering a minor incentive of 1 BCH (requires pre-approval) for publication of reasonably detailed design documents from current projects.

Minimum Requirements:

- Pre-approval from me (for 1 BCH - obviously anyone can post whatever they want). You can contact me in private wherever. For example on telegram or in messages here.

- Medium term (not current) architecture diagram of how you think a BCH-native ecosystem should work. Wallets, app stacks, libraries, web apps, mobile apps, browsers, mobile devices, etc.

- How should a BCH-native wallet handle arbitrary utxo and contract state?

- How should a BCH-native wallet handle arbitrary utxo and contract state backup and recovery?

- How should a BCH-native wallet handle exclusive or shared ownership of utxos?

- In terms of “BCH native stuff”, where is your project today vs. where you are going?

- What lessons have you learned, what should other projects do / not do based on your experience so far?

- What issues do you predict are not visible today that will be important in the future?

- What do you need that you wish already existed?

- Are there any specific things you are working on that might become a standard or that you wish we already had a standard for?

A note regarding CHIP Process: As described in the CHIP process, it is intended for hard-line decisions that must be made one way or another, not for softer, open-ended issues like this. Anyone can make a CHIP for whatever they want, but I do not support any effort into making a CHIP out of this topic.

Also for recovery, although offline is possible, I suspect the eventual go-to solution will be public but encrypted storage of recovery data, maybe through a paid service?

Also for recovery, although offline is possible, I suspect the eventual go-to solution will be public but encrypted storage of recovery data, maybe through a paid service?