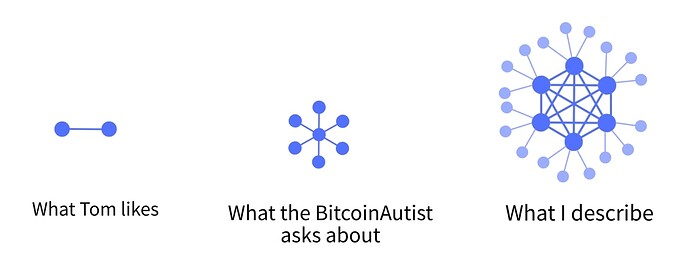

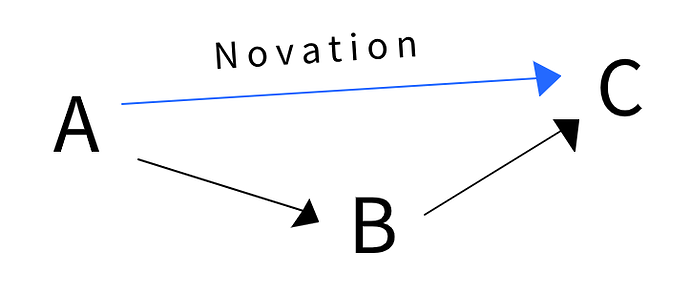

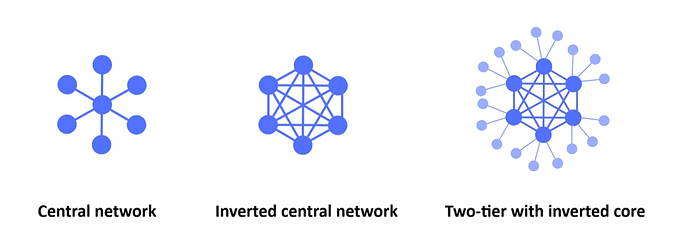

Tom here favors the idea that users use payment channels simply for back and forth payments. This is a step backwards by 10000 years or so. But, it is also a very simple system. A slightly more advanced version of that, is to use 3-party novation. 3-party novation is a mostly unknown mechanism even though it has been around for thousands of years. It is very simple: you take a normal central network, you invert it, and then you can computationally operate in decentralized way but still work accounting-wise as if it was a central network.

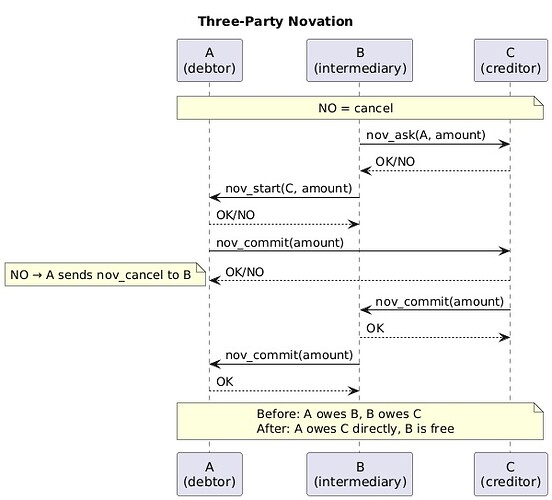

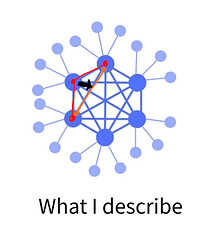

Any node in the inverted central network that has both debt in and debt out, can then request to move, or “novate”, that debt so it is directly between the debt in node and to the debt out node. This is the same thing that happens in the central network variant with A to bank to B to bank to C, but it is computationally decentralized, i.e., fast. And with payment channels with Bitcoin behind them, also trustless or trust-minimized.

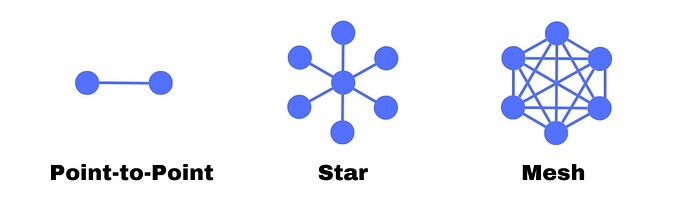

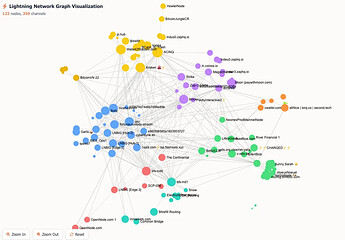

The network of routers does not have to be a perfect inverted central network. I.e., everyone does not need to have links to everyone else, but the closer you get to the ideal the better it works (to the point where it works perfectly when it is perfect inverted central network).

I 100% favour the multihop payment approach and a true Lightning Network (or Raiden Network and anything else) but sometimes a simpler system can be good for the short term. This I describe here is meant to be a 2-tier system. There will be the routers, and, then the users. The users have payment channels to a router. And they can pay any other user via the routing network, over three hops. The routing network internally does 3-party novation to simplify the debt graph maximally.

This is an extremely simple, yet powerful, system. It might work well with something like Nostr, which is intended to be a two-tier system anyway (also a compromise…) You’d have users running their “LN light” wallet on a mobile phone, via Nostr they do payments, and the routers interact internally to do most of the complexity.

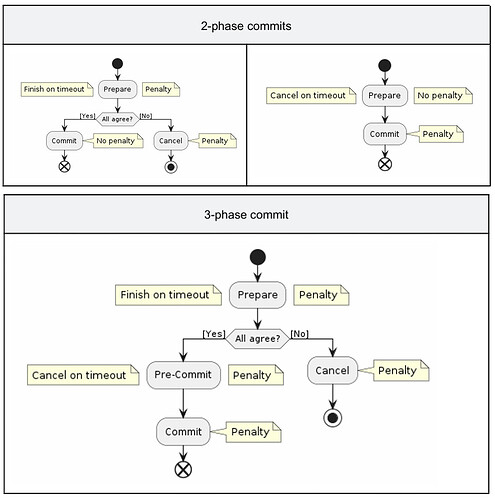

I have an implementation of 3-party novation since the past few weeks, I coordinated it as here.

This is for open discussion. Yes the “just build it and shut up” argument can be made. But there can also be discussion. I do not think most people here are even aware of this possibility. 3-party novation sems to be pretty unknown even though it is thousands of years old.