BitcoinAutist has reasoned falsely here from the start and demonstrated that. And acknowledged he was not aware of novation.

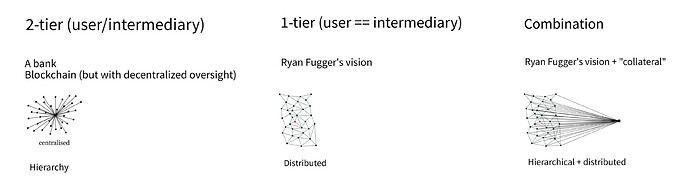

Lightning Network is based on Ryan Fugger’s ideas for Ripple that date back 2003. Satoshi (Craig…) referenced Fugger’s work in emails with Mike Hearn as “the only other project to do something interesting with trust besides centralizing it”. Now these days, Lightning Network is well known, but those were the roots. It uses the 2-phase “cancel-on-timeout” that Ryan invented (which is not secure, this is one thing holding such networks back, and the secure version was invented by me last year see here).

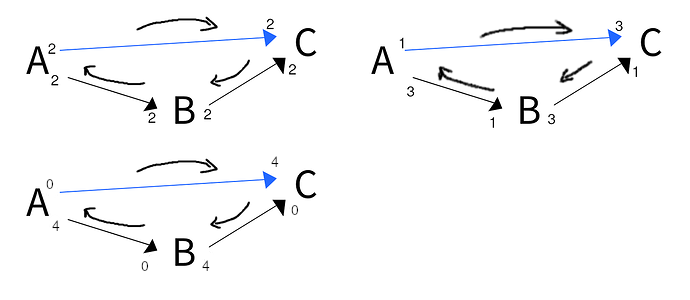

Neither Ripple nor LN or anything along those lines were about novation, since they were multihop in terms of trust. Novation is “dumber” as it is singlehop trust-wise (but with payment channels this is not the same type of problem). Both Fugger and LN had more advanced visions.

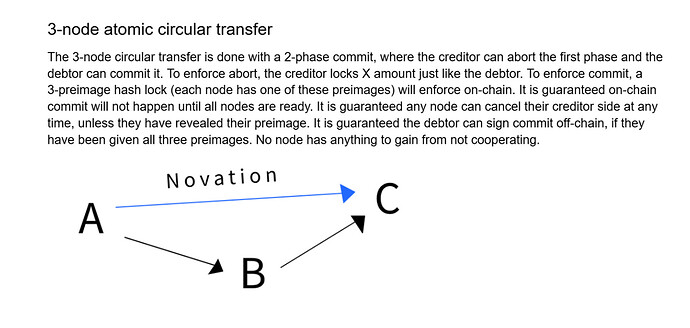

The multihop clearing is loop clearing. This is well known since thousands of years. That novation is “just circular payments” is misrepresentative. The typical loop clearing (in the paradigm that Fugger and LN was part of and Evgeni Pandurski worked on too) is along debt. These are “just circular payments” yes, that is exactly how those are done, and why they exist in LN. But novation is not just a circular payment. It is not along debt at each hop, and it is only meaningful in a specific scenario: only one of the three nodes is intermediary in terms of debt. Randomly doing three node “loop payments” would only achieve this in very few cases.

BitcoinAutist just demonstrates poor judgement and ability to discern. No, novation is not built-in to LN, it is anti-thetical to what LN had as the goal. It is a mostly missed possibility. I describe it well, and I show how it makes every step of everything easier, see article that I shared previously.

I am not so sure I am the “loud minority”. I think lots of people interested in Bitcoin and the Cash or any other fork or Ethereum or anything along the same lines, are pretty balanced and reasonable. But there are a few loud ones who build their identity on it, maybe life is poor otherwise.

The thousands-of-years-of-banking appeals are a red herring. Traditional banking “solved” these problems by having a trusted central ledger that can create accounting entries at will. Payment channels are fundamentally different because they’re backed by actual UTXOs with fixed capacity. You can’t novate your way out of that constraint.

They solved it most likely with the inverted central network. Which yes requires everything is trusted internally. This is why there were family monopolies or ethnic. But with payment channels, it does not require trust. This is something people miss.

I didn’t unwrap this yet (link to paper), don’t understand what problem it tries to solve, so can’t comment much now.

You need a penalty on each phase for “chunked timeout” to work. Otherwise, nothing stops attack on the phase without penalty, thus you end up undermining the timeout as the solution to “do-nothing” attack. Ryan never achieved a penalty on all phases. It is ideally done with the 3-phase I describe (and implemented, my network runs on it…) but you can also do it with 2-phase by both “cancel on timeout” and “commit on timeout” (Ryan likely knew that but he has not mentioned it in the 2003-2010 period when he lead things).