and what are your thought about the centralized server issues faced by various coin-joins methods

and thought about coin-party

https://www.reddit.com/r/Bitcoin/comments/3o0vv2/kristov_atlas_coinparty_is_a_new_p2p_mixing/

and what are your thought about the centralized server issues faced by various coin-joins methods

and thought about coin-party

https://www.reddit.com/r/Bitcoin/comments/3o0vv2/kristov_atlas_coinparty_is_a_new_p2p_mixing/

This is a separate topic, please respond in an appropriate topic. I will not do offtopic here.

You said “we”.

Let us know what your git home is and where we can work together on the code you’re writing to get those ideas realized.

Well, they are talking about it.

https://twitter.com/HodlMagoo/status/1758234845430284332

And some more miner data I found.

There are some major tricks that we can pull (and btc cannot) to make for a much more decentralized, noncustodial and market-friendly pool due to our superior scripting capabilities - think p2pool but with so many goodies to make you drool rivers.

Unfortunately that would be a massive undertaking (think millions $) from design to implementation to marketing while yielding little revenue for the developers, so I don’t think we’ll have a manpower to do that anytime soon unless there’s a major investment. We can barely keep the old and really shit p2pool working off a part time miner coding in python. =\

Found some in dept article on possible pool collusion.

Related, quoting mononaut from X:

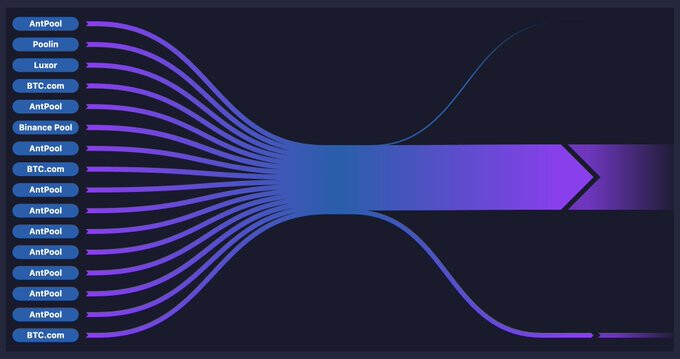

A single custodian now controls the coinbase addresses of at least 9 pools, representing 47% of total hashrate.

As demonstrated by this consolidation of mining reward outputs from AntPool, F2Pool, Binance Pool, Braiins, btccom, SECPOOL and Poolin:

https://mempool.space/tx/b1dc9e09a97d0ac8ed57179c276dff19d484c1f74b96cd9af547107af4f18086

TIL that over 40% of hashrate send their mining rewards directly to the same custodian.

I believe that custodian is Cobo, based on the on-chain flow of funds and some circumstancial evidence.

Whoever the custodian is, they’re also actively sifting out “uncommon” ordinal sats from those freshly mined coins

https://mempool.space/tx/ed58e2174f0ab4ab977c8f8775a2c5dd15dc0068537f72225b4399797cb9c83d

@bitcoincashautist mining and mining pool need to be blinded or else we will get more censorship and empty block attacks

forget amounts privacy

Mining is too much transparent linking everything and is slowly becoming an attack vector due to centralization

That would be great but it is not an easy thing to do.

Are you suggesting something specific or just brainstorming?

two solution may exist either zero knowledge mempool construction and miners batching transaction in their pool

or some form of ecash(real one) compact blind signature(of course truly decentralized this time) only on batching miners transaction

so amount is public & supply is auditable

but mining pool, mempool design and batching transaction by miners could have some privacy (in form of encryption)

if one wants to go even further limit sender receiver amount to public (but super bad idea) but miners and mining pools and mempool construction has some sort of privacy

Wow, never heard of these. Sounds like an exciting piece of technology.

Can’t wait until you code it.

https://nakamoto.observer/analytics

[Foundry USA] 34.75%

[F2Pool] 12.07%

Both are US pools and fully KYCed.

I don’t want to be an alarmist but I hope our devs have some emergency strategy for when this turns out to be another nook around Bitcoins neck.

I believe a simplified UX/UI P2Pool scheme that can be integrated into nodes might address part of this issue by decentralizing mining and reducing reliance on major pools. Since P2Pool operates as a peer-to-peer mining pool, it avoids centralization of hash power, making collusion less feasible. It also enables people with less mining power to participate effectively.

This is a BitcoinCash forum, maybe you missed that for BCH those two have very very different numbers.

Seriously?

You know very well that BCH shares the hashing power with BTC, so these numbers apply to BCH today, and will apply even more tomorrow, when BCH overtakes BTC as the #1 coin.

Ultimately, all PoW networks are secured by value of their block reward. Hashes are a commodity that blockchain networks buy with their block reward and immediately spend on security. If we want to stay pure PoW then the only way to become more secure is to have a more valuable reward because that will allow us to purchase more hashes. No other way. Changing the algorithm wouldn’t really do anything other than obfuscate the reality of PoW: it is the value of mining work done that secures the network. With another algo, we’d be buying the same value of hashes, just on some other market.

How would it look like if Bitcoin magically switched to GPU or CPU algo? Who owns most of general-purpose compute? The few fully KYC’d companies like Google would have the compute to dominate CPU or GPU PoW mining. Last time I did the numbers: 5% of just 1 Google’s datacenter could replace 100% of XMR’s hashrate. So, instead of Foundry, F2Pool, it’d be Google, Microsoft, Meta, Tesla…

Bitcoin (BTC) has about 450x the security budget of Monero ($36M/day vs $80k/day), so it’d take about 23 datacenters. That kind of new demand for compute would balance against other uses, companies would probably use PoW to fill in gaps in other compute demands etc. Nobody can really tell how the market would evolve if Bitcoin had a CPU algo.

Here’s a little post I originally wrote on X, arguing that sha256d is the best algorithm to have:

Reminder that sha256d is the best algo because it has the most developed ASIC tech and hash market

ASIC-resistance is an anti-feature IMO, because there’s way more CPU compute available for sale to highest bidder - that could be used to target any ASIC-resistant PoW network

Harder to buy sha256d compute, because all ASICs are already busy mining PoW for themselves

Ultimately, all PoW networks are secured by value of their block reward and algo doesn’t matter as much as people like to believe

But how would you sell “same” to investors? So, there were incentives for new chains to be different just because, just to be different

Also, there’s the perception that being minority hash is a bad position, but ASIC-resistant algos are minority hash in the grand scheme of things - CPU algos are less than 0.1% of available compute out there

If you start a new chain, you’d want rapid move from CPUs to ASICs, then your chain can have all the specialized hardware for itself, but you need to pay for it - you need enough market value and block subsidy to crowdfund ASIC R&D

BTC already did that for sha256d, might as well just use sha256d and buy hashes on the best hash market

Obviously, yes.

What we need is some kind of smarter solution like maybe an efficient anon mining pool built into node software or something like that.

Just changing algo is not a long-term solution, that will work for a week tops. So trash solution.

The problem is obviously not normal miner operation or BTC miners attacking BCH. The problem is the US controlling 50%+ of the SHA256 hashrate and dictating their KYCed miners to do their bidding or get stuffed.

This could mean no more cashfusion tx or missing OFAC-sanctioned transaction etc.

I don’t care about BTC, they will gobble this shit up because YEAH Bitcoin backed Dollar and NgU but for BCH this could mean trouble.

I wasn’t thinking of switching to CPU or GPU mining but that might be necessary for a short time. With my limited experience I would guess there are two ways out of this: decentralizing pools so miners can stay anonymous because they do not need to rely on big centralized pools for their income. Or switching algo to something the US doesn’t have 50%+ of the hashrate.

No need to rush anything, this problem could solve itself.

All it takes is a single decision from China to let the miners back in.

Power in china is significantly cheaper than in US, I guess the miners would jump back in in no time.

EDIT:

I guess China did not figure out that US very probably plans to create a new digital FED and base it off BTC, for this they need to control the hashpower.

China letting miners back in or China openly supporting BCH as alternative to BTC has the potential to totally wreck these plans.

It will have 50%+ hashrate of any algo because it is #1 economy in the world and has the most compute hardware.

And only in the USA do the people have a fair chance of challenging the government.

Miners could dodge whatever rules, at least in part: Debating the implications of largest mining pools rolling back transactions to sanctioned addresses and its effect on network consensus - #18 by bitcoincashautist