old.reddit.com/r/btc/comments/17x6rnb/til_the_two_largest_btc_mining_farms_in_the_world/

Critics Alarmed as 2 Major Mining Pools Dominate Over 50% of Bitcoin Hashrate

Control Over Bitcoin’s Hashrate Is a Nuanced Topic

Currently, Antpool leads with a 30% share of Bitcoin’s total hashrate, closely followed by Foundry USA, which holds 26%. Together, these pools exert a 56% influence over the network’s 468 exahash per second (EH/s) hashrate.

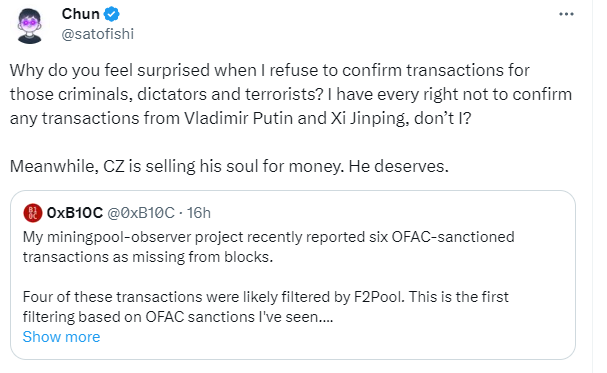

“The [two] largest bitcoin mining pools, together controlling over 50% of hashrate for over [one] year now, are regulatory-compliant and require all miners to comply with KYC,” Blec said. “The government has clear identification, visibility [and] control over more than 50% of Bitcoin’s miners (by hashrate).” The researcher added.

So basically the question here is, what are the possible implications of two biggest mining pools colluding to roll back several blocks in order to be regulatory compliant?

Is this something that will become an issue, or maybe game theory and greed will solve these in some way?

What are your thoughts on this topic?