We recently wrote a research paper that empirically investigates the miner’s hash supply response to the difficulty in the SHA-256 currencies using econometrics techniques. In this paper, we evaluated the performance of the DAAs including ASERT, and found that ASERT clearly outperforms CW-144 and BTC’s original DAA.

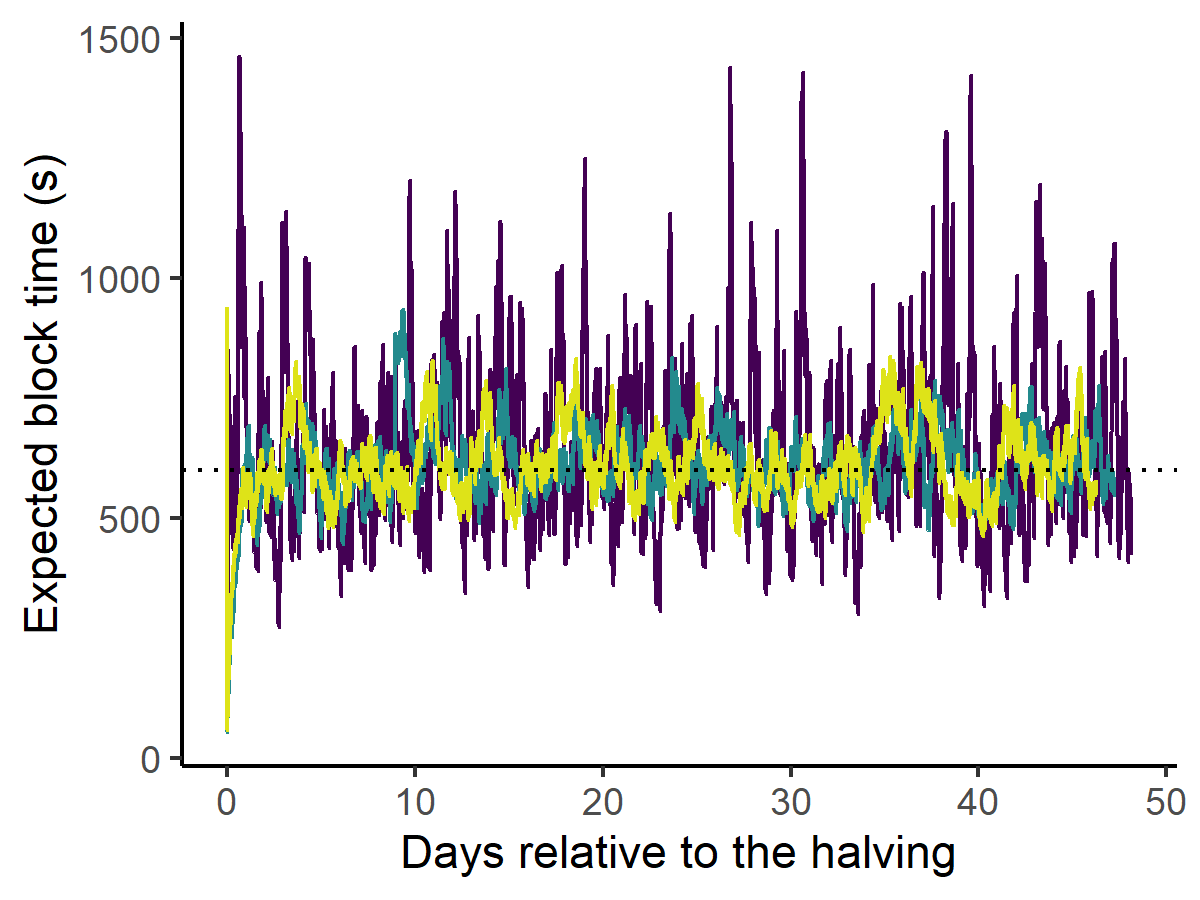

Attached are the key counterfactual simulations results. This is a simulated series of block times starting from the timing of BTC’s third halving. The simulation is based on the estimated miners’ response function to the difficulty, which is inferred from data using econometric techniques. The purple line is the simulated block time when BTC uses the original DAA, BCH uses CW-144, and BSV uses CW-144, the green line is when BCH upgrades to ASERT, and the yellow line is when BTC, BCH, and BSV all upgrade to ASERT. The paper includes other interesting results as well.

I am not sure whether it is okay to post an advertisement for my own papers, but hopefully sharing this helps you to better understand the performance of ASERT.

Security-Cost Efficiency of Competing Proof-of-Work Cryptocurrencies

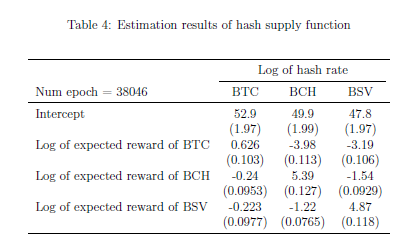

Proof-of-Work cryptocurrencies consume vast energy to rule out potential attacks. Therefore, evaluating and improving the security-cost efficiency, the cost of attacking the system per unit of operating cost, is important. In this paper, we demonstrate that the stability of miners’ supply of work over time is essential for the security-cost efficiency, and it is determined by the Difficulty Adjustment Algorithm (DAA) of the currency and the reward elasticity of the miner’s supply of work. To this end, we develop a model of the multicurrency mining market and estimate the own- and cross-elasticity of the hash supply to the reward by exploiting the reward shock event, called halving. We use the estimated model to simulate the mining market and evaluate the security-cost efficiency. We find that Bitcoin is stable because of the inelastic miners, regardless of the DAA, whereas other smaller coins face highly elastic miners and can be stable only with efficient DAAs. Upgrading all relevant currencies’ DAAs to the state-of-art one substantially improves the security-cost efficiency and saves the energy-consumption rate by 0.21 GW or 3.2% while maintaining the security level.

Which is why I think survival of all SHA-256 coins is in the best interest of miners, because each has the potential to increase total addressable hash market. It doesn’t pay to play favorites. Hashrate allocation across coins is a matter of simple economic calculation, and hardware ROI comes from total value of SHA-256 rewards. Therefore, if market success is not a 0-sum game then it makes sense to protect even minority coins, sometimes at a cost (sub-optimal mining, doesn’t necessarily mean mining at a loss).

Which is why I think survival of all SHA-256 coins is in the best interest of miners, because each has the potential to increase total addressable hash market. It doesn’t pay to play favorites. Hashrate allocation across coins is a matter of simple economic calculation, and hardware ROI comes from total value of SHA-256 rewards. Therefore, if market success is not a 0-sum game then it makes sense to protect even minority coins, sometimes at a cost (sub-optimal mining, doesn’t necessarily mean mining at a loss).