It’s crucial for the future of the DeFi ecosystem on Bitcoin Cash to have a robust oracle solution. So this is very important discussion to be had  we need to make sure we have a good foundation to build an ecosytem on-top of.

we need to make sure we have a good foundation to build an ecosytem on-top of.

Current situation

Currently the only production oracles on BCH are the ones run by General Protocols on oracles.cash, used for AnyHedge contracts and BCH Guru contracts. The 24 oracles have a commitment end date as mentioned above

Commitment End

2024-09-30T23:59:59.000Z

There’s multiple disadvantages of such a simple oracle setup

- Single trusted party as price source

- No business model because non-exclusionary (encourages free loading by others)

- Nothing directly at stake by data provider (besides reputation)

Tokenization

Tokenizing the oracle messages has the potential to solve 2) because consumers of NFT price interface could be charged upon usage.

Charging a fee for oracle usage is also part of the v2 oracle draft spec for oracles.cash by @Jonathan_Silverblood of GP.

This approach leaves problem 1) and 3): reliance on a single trusted party with “only” reputation at stake.

Aggregation

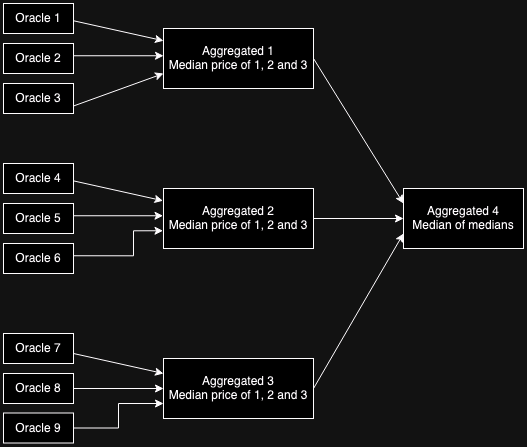

The D3lphi oracle contract by Riften Labs attempts to solve the reliance on a single trusted party:

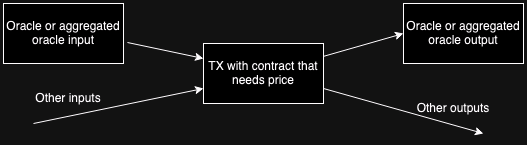

Price aggregation

Additionally, there is a contract ( aggregated.cash ) that takes 3 other oracle contracts as input and publishes the median price of the three.

The goal is to have multiple independent oracles and be able to get a price within a contract that is resistant to one or more of the entities “going rouge”.

The idea of the contract design is simple, just take the median of 3 to solve reliance on a single data provider.

Notable in the design is that the actual data providers/signers are not paid, just the aggregator in the contract.The question then becomes what the incentives for the signers would be to part-take in this, besides trying to collude and manipulate the outcome. Even if the signers are honest, what are their incentives for monitoring the pricedata, having consistent uptime and publishing all the onchain messages?

So while the aggregation contract solves 1) it actually doesn’t solve 2) for the signers, and makes 3) somewhat worse as it is harder to find 3 different parties with enough vested interest in having a spot-free reputation.

Conclusion

To me it seems like to get a good foundation for the future DeFi ecosystem on Bitcoin Cash, we need a robust oracle solution which incentivizes data providers and can slash stake on dishonest behavior.

We should look over the fence at popular oracle solutions in the wider crypto-industry. Chainlink is the defacto standard on EVM, so we should investigate what they do well and what they do badly.

we need to make sure we have a good foundation to build an ecosytem on-top of.

we need to make sure we have a good foundation to build an ecosytem on-top of.