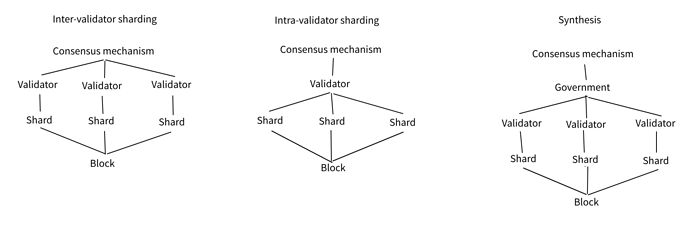

I came to the conclusion of ordering transactions in Merkle tree by myself over the past week, as it is required to allow the type of parallelization I think is meaningful, and learnt that Bitcoin Cash had gotten there already by 2018. Good job to this community. The reason such ordering (CTOR) is meaningful is because it allows shards to contribute to the “proof-of-structure” in parallel (with a degree of sharding that is arbitrary, i.e., a node can use no sharding, another thousands) while respecting the Nakamoto consensus with a singular central authority that signs each “block of authority”.

I want to emphasize that with the sharding that Bitcoin Cash can now do since 2018, shards can also be geographically and socially decentralized (whilst operating as “teams” that have a view of the entire state at any given time). The “node” can become like a “mining pool” but for the blockchain itself, and nodes (teams) compete to verify the state is correct. This scales infinitely. Note, transactions are “owned” by shards so to use a UTXO from another shard you request the right, and it is first-served basis.

Such predictable ordering of “proof-of-structure” (that the Nakamoto consensus can then sign and attest to that the “team” agrees with the correctness of the state, and if they lie and the state is invalid the block is refuted by others and mining reward lost) can be achieved with other architectures than Merkle trees. Merkle trees cannot be ordered over all time, thus they need to sort transactions into blocks (and likewise, authority has to be in “blocks” in Nakamoto consensus, so, two birds with one stone). I was thinking (but this goes beyond Bitcoin Cash and is placed here as an open question): What if for the proof-of-stricture that is signed with Nakamoto consensus, we instead use a Patricia Merkle Trie? A singular trie, and nothing else. And the Nakamoto consensus signs the root of this trie in an “authorization hash-chain” that only contains the signatures and previous authorization hash. I.e., the “block” becomes a block of time of authority, and the proof-of-structure is not confined to block anymore as with Patricia Merkle Trie it can be ordered over all time.

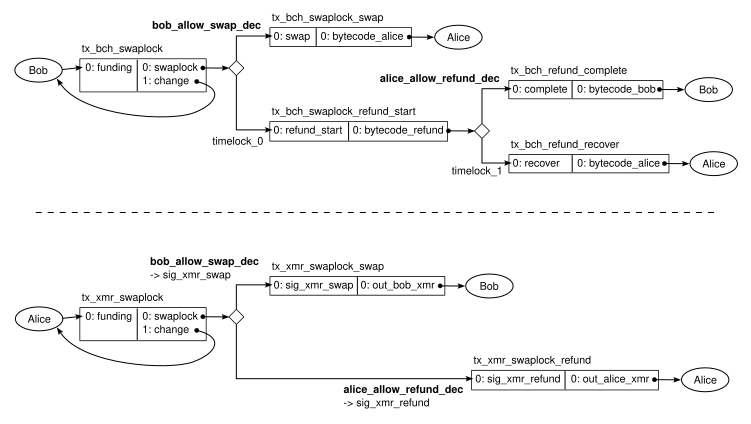

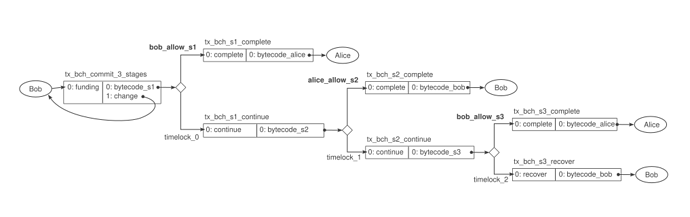

This architecture is speculative, I ask others if you find it interesting or if it sounds retarded. Also, if anyone is interested in perfecting a Lightning Network on BCH I solved the coordination game theory for that, see here: https://resilience.me/3phase.pdf.