I’ve been playing with the idea of creating a token representing an asset (like USD or GOLD) based on having BCH as collateral. Currently I have only the concept and a contract that compiles, but is sure not to work (it’s currently too large for BCH consensus rules). EDIT: It now fits within consensus rules.

Looking for “concept acks” if the idea is sound.

Contract is hosted here: Dagur Valberg Johannsson / BCH pawnshop contract · GitLab

I’ll post the README below:

Pawnshop contract

Status: Feasibility study

An oracle based contract that lets you borrow tokens representing oracle asset against BCH collateral.

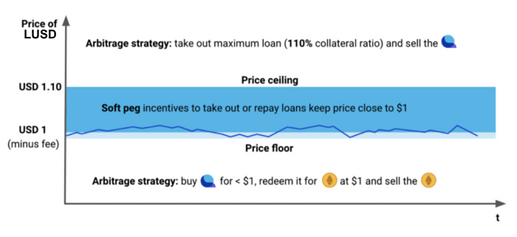

The borrowed tokens would have a “incentivized floating peg” – there are built-in market incentives for the borrowed token to be close to the asset borrowed against.

The contract requires over-collateralization for borrowed asset. When a loan does not fulfill the collateral requirements (due to BCH price going down), then the loan becomes “anyone-can-repay” – anyone willing to repay the tokens can claim the collateral.

Incentives

If the price of the borrowed token is too low, existing borrowers are incentivized to purchase token from the market to repay their loan for below-marked-value.

If the price of the borrowed token is too high, new borrowers are incentivized to take loan to profit from overvalued token.

Note that these incentives may not be sufficient. It is likely that in a bull market that speculators would be willing to borrow “below market value” to gear their investments. In a bear market, borrowers may want to unlock their BCH, competing with others seeking “refuge” in the coin.

Contract

The main contract stores an oracle sequence number in a NFT commitment. The main contract (pawnshop.cash) has two functions:

-

updateSequence – this updates the sequence of the oracle message.

Someone™ has to call this regulary in order for stop malicious borrowers from

minting tokens based on old price. -

borrow – This lets borrowers lock BCH into a loan contract (loan.cash) and in

return mint asset token.

The loan contract stores the borrowed amount of asset token in a NFT commitment.

The loan contract has two functions:

-

addCollateral – This lets the borrower add more BCH collateral.

-

repayLoan – Repay the borrowed tokens and unlock the BCH.

If there is enough collateral, only the loan holder can repay.

If there is not enough collateral, anyone can repay.