I’ll go straight to the point. The first app/wallet that can offer a simple way to exchange fiat currencies with a straightforward UI, coupled with a good enough on/off-ramp for users, could take a big chunk of the remittances market. We’re talking Billions

What that “app” needs:

- A behind-the-scenes DEX to handle the fiat-to-CashTokens swap. For example, different users could sell their MUSD in exchange for €, while others buy that MUSD using their target fiat currency.

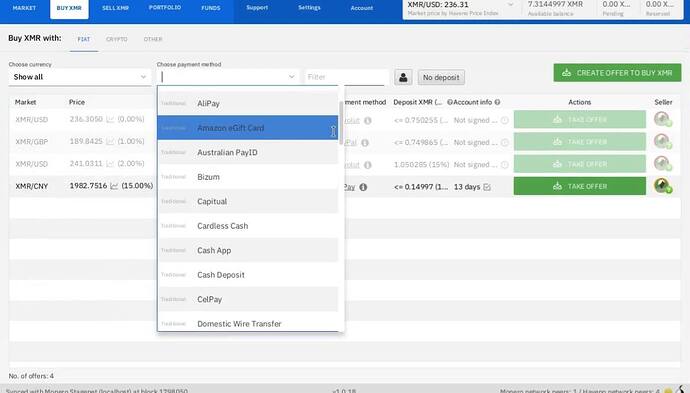

- Fiat on-ramp: This is the part that has me scratching my head the most. It’s the most important because it’s the one that will actually move value onto the chain. If we mess this one up, that’s it—game over. Minimizing friction is key, but the payment market is very fragmented, so catering to every single option isn’t realistic. Compromises will have to be made to target particular markets.

- Off-ramp: Not as important. I know it sounds counter-intuitive, but hear me out. Once your money is locked in the app, the user will figure out a way to use it—especially if we’re talking about the recipient (who actually spends the money) getting it from a family member in another country.

In areas with significant merchant adoption—like Buenos Aires or the Philippines—this could get the ball rolling much faster.

Why I think we’re ready for an app like this:

All of this you can already do; it’s just that no one has put it all together in one seamless solution.

- You can buy BCH with your credit card on the Coinbase app or in the Bitcoin.com wallet.

- You can swap CashTokens on a number of sites (e.g., DEXes like Cauldron).

- You can sell your BCH on many CEXs and get fiat deposited to your bank account or whatever local payment processor is popular/hyped.

Unifying these three things is the killer app, for mass adoption in my opinion.

Let’s put an example: Imagine Argentinians working in Europe. Every month, they send a few hundred € home. Current options include Western Union, Remitly, etc.—those are relatively straightforward but expensive, not only due to commissions but also because they don’t always offer the best exchange rate. A more advanced user might have an account on a CEX like Coinbase or Binance, buy crypto there, and then swap it for pesos on a local exchange. That involves using ~2 or 3 different platforms, and the savings aren’t always huge—maybe they lose 2% in the process. This person would switch to a better alternative in a heartbeat. So, if they could just open an app, type in an amount in €, send it across the Atlantic for less than 1% total cost, and the recipient has a good enough way to spend it… that’s game over. Extra points if, after the first transaction, the rest are one-click simple—like Amazon’s checkout.This would incentivize merchants to figure out how to interact with end users who now have cash in their pocket. Merchant POS software becomes the ideal off-ramp, and once word spreads, more merchants would jump in.

ATMs could be a nice off-ramp too, but that requires more hardware—though I’m sure there are off-the-shelf solutions that are easy to set up. But deploying hardware is expensive and that cost goes back to the user defeating the point.

I’d love to hear your thoughts. Do you think a collaboration between some of the projects can pull this off?