Did a little analysis of block times: https://twitter.com/bchautist/status/1775125674300198967

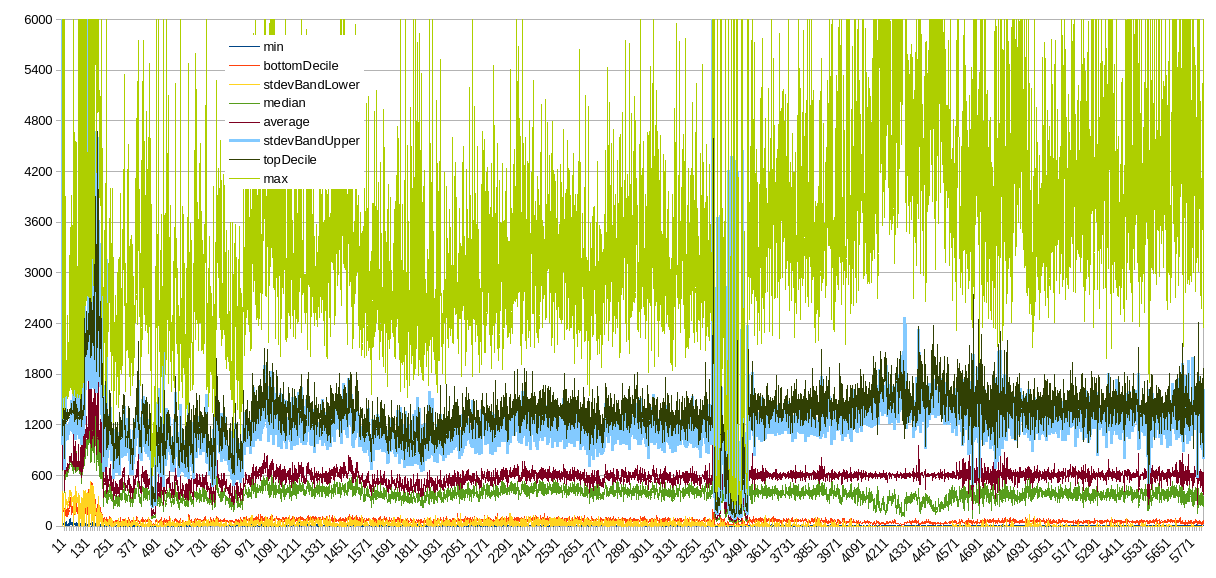

The period until the obvious anomaly at x=3371 is pre-fork and that is shared history with BTC. Notice how volatile it was at early days of Bitcoin?

-

The anomalous area between x=3371 and x=3491 was the fork DAA era which was heavily gamed by miners to speed up the chain, and so BCH is now some blocks ahead of BTC, and it is the main reason why our halving is coming a little sooner

-

Then, between x=3491 and x=4571, we had cw-144 DAA which was gameable but to a lesser degree, block times were more stable but there were cyclical oscillations: notice the median dipping with only the average being stable. I think at first it was fine, until pools figured out how to game it, which can be observed on the chart.

-

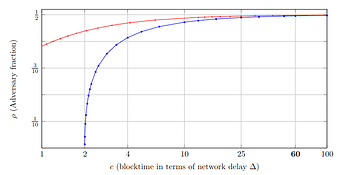

Finally, we got the ASERT DAA which performs really well, and there’s even been some academic work analyzing it

Note: the plot is based on absolute difference between block times as read from block headers, which don’t always match the real clock.

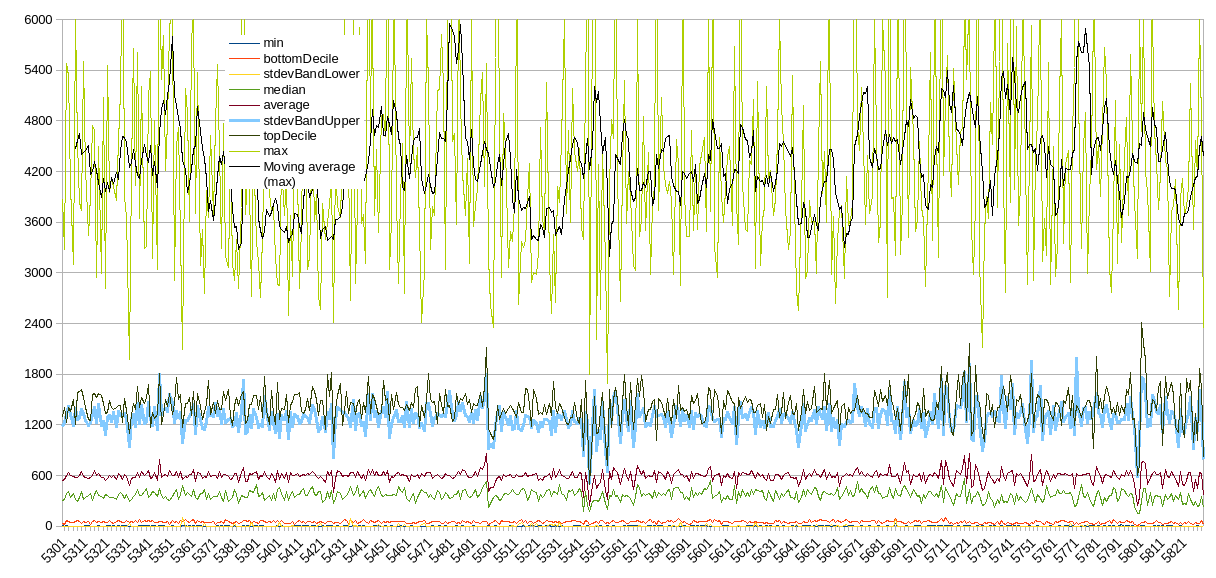

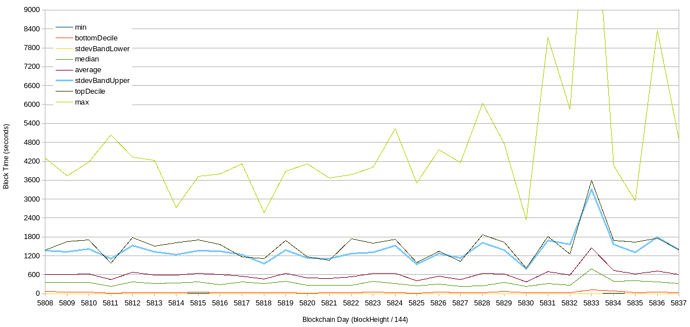

Zooming in on the last 3 years, we can see some day-to-day volatility but things look generally stable. Note that big price movements can temporarily speed up (while price is moving up) and slow down (while price is going down) the blocks!

Thing is, each day will have 1 or 2 blocks which take more than 1 hour, and people tend to notice those, because there’s always people making transactions, and so there will always be someone who happens to make a TX at that time and he’ll be annoyed by the wait. Sometimes that someone will be you.

If more services adopted 0-conf, nobody would notice. It’s usually people waiting on payment processors or exchange deposits that get frustrated by the wait.

Payment processors could safely accept 0-conf if they wanted - usually the shipment of some good/service is not immediate and it can be reverted if someone tries to double spend. Also, we have double spend proofs which can serve as evidence and be used to punish the customer who tries to do the equivalent of shoplifting.

Exchanges could accept some risk, and have a 0-conf budget for their customers, allowing smaller deposits to be processed immediately.

With 2-minute block times, we’d still have extremes but they would then mean that every day there will be 5-10 blocks which take 14 minutes instead of 1-2 blocks which take 70 minutes. This could reduce frustrations with payment processors who usually require only 1-conf, but exchanges would likely adjust the required number of confirmations.

If starting a new chain, 2-minute block time would be a better choice than 10 minutes. However, changing an already existing chain’s block time would be a big cost on the whole ecosystem because things were built with assumption that it will never be changed, so I doubt it would be worth the trouble.

PS

It’s always the block you’re waiting for which will be the outlier

– Murphy’s law of blockchains