-

You are mixing 2 things. How well 0-conf works has currently literally nothing to do with how it is received by the populace. Good PR is missing here. You cannot fix PR problems with tech. Prejudiced/brainwashed people are the problem, not the tech.

-

It’s not the only solution, nobody said that. In fact, the community is currently working on other solutions. But it is a very good solution, still.

Please note that wallets (like mine) optimize for spending confirmed transactions over unconfirmed ones.

Which makes the scenario you state extremely unlikely.

Wallets should also become more active in things like fusing transactions automatically and splitting utxo’s for anonymity and, yeah, having confirmed utxo’s available when you need them.

That is a good question, and I’d like to add that instead of changing a core property of the network (which will take at least 18 months to activate) the question may be asked: what kind of direct end-user visible things can be done to improve the user experience?

I mean, we can start with all these great features we added to the basic platform-that-is-bitcoincash and most of them haven’t actually been used in a way that end-users can use them. Which is what I meant with the question of what to spend your (and everyone else’s) time on.

When it comes to net-gain, the low hanging fruit is not going to be any protocol change. There are tons of things needed at the end-user-side (apps, services, etc) which take a lot less time to do and a lot less time to reach the users you want to reach. At least, that’s how I read your post. You want to improve the end-user experience…

As a (I hate the term) senior dev, my suggestion is to pick something smaller and much closer to the end-user.

Because in the end, 2 minute isn’t good enough either for all those things that really do need zero-conf.

You may control individual apps but you can’t fully control whether the users will find their way to them or find them before they find those others. If they come to you, you can control the UX, sure, but what if they enter through elsewhere? The “elsewhere” of whole of crypto is big and wide now. It is beyond our control and yet the 1st contact with BCH for many people could be through one of those. Big multi-crypto payment providers dominate the online commerce aspect of crypto, do they not? That’s the environment in which we’re trying to grow now, and we can’t wish it away.

We have the possibility to improve UX all across those in one node upgrade cycle, without them having to lift a finger, without us having to beg them for anything, and all our existing and potential users would benefit from the moment the upgrade is activated.

Nobody’s complaining when they get lucky with a 3-4 minute block, but people are often complaining when they get one of those unlucky 30-40 minute blocks. What if we could make our luck persist and make most blocks “happen” to be under 5 minutes?

When people learn the network has 10 minute blocks, it sets the expectation of a 10 minute wait. Every additional minute above 10 minutes will have them wonder what is wrong, the longer it’s delayed the longer they wonder and the greater chance they remember their annoyance or are prompted to go and complain.

PoW mining being a random process means your wait time is like a repeated lottery draw, you draw every minute and:

- With 10-minute target, every minute there’s a 90% chance you’ll have to wait 1 more minute, and 37% chance you’ll have to wait 10 more minutes!

- With 2-minute target, there’s only a 60% chance you’ll have to wait 1 more minute. and only 0.67% chance you’ll have to wait 10 more minutes.

It’s the difference between average 10-minute wait, with individual experiences varying between 0 and 47 minutes (99% blocks will be in that range), and no more than 10-minute wait - a promise 2-minute target could fulfill with 99% confidence.

Lots of text. But you nicely forgot to actually counter the point:

People won’t wait 5 minutes, nor 2 minutes at the checkout after payment. Anything over 10 seconds is too long.

If you want to make that happen with block-times, go start a new blockchain.

Checkout, where? Physical checkout? It’s a deal-breaker for supermarkets, sure, they’d either accept 0-conf or nothing. Restaurants? Few minutes could be just fine, while 30 minutes would be an awful experience. Online? Few minutes aren’t a problem, but 30 minutes are still a pain. Food delivery? Few minutes additional wait are fine, 30-min of nothing happening? Ugh.

We could argue it could increase willingness to accept 0-conf, too, because it would make trying to cheat more risky for the culprit - even if he had a rogue pool to skip public mempool, risk of getting caught 30 seconds later would be 22% with 2-min target vs 5% chance with 10-min target.

Sure, anything over 10s is not anymore “instant”, but few minutes are still tolerable in many cases while 20-30 minutes hardly are. Right now, we can’t promise “it will be just a few minutes, 10 minutes tops” when we regularly have those 20, 30, 40-minute blocks. With 2-min target we could actually promise “it won’t be longer than 10 minutes”.

10s is not feasible for BCH, or it would require a too radical change. J. Toomim wrote:

Ethereum has the Inclusive protocol uncle mechanism which mitigates the effect of orphan rates on centralization by about 7/8ths. A 8% stale block rate on ETH is roughly equivalent to a 1% orphan rate on BTC in terms of the centralization effects it has on the mining ecosystem. Adding an uncle mechanism was proposed for BTC but never adopted. If BCH adopts some sort of uncle mechanism, that would likely make shorter block times more viable. Uncle mechanisms are tricky to get right without breaking incentives, but it may be worth it, and is probably worth considering.

It is not on the roadmap, and it could be added, but it comes with a big cost: it will be a big change, and will require a lot of new code and could introduce new vulnerabilities. In particular, it could make selfish mining attacks more harmful if we’re not careful.

Changing the block time is well researched and costs & benefits & risks are well known and understood. It’d just be more of the same, all we lack is the will to do it.

arguably, the #1 service for ppl like myself that live ONLY on crypto is Bitrefill … abd for years, i’ve heard that same argument used as to why they don’t support BCH … however, the much more “obvious” reason is the BCH UX would be tragic burdensome (unknown wait times for “instant” delivery of digital goods) on their support staff … so imo, this IS NOT a PR issue, but a “business” issue…

0-conf is the only solution being “actively” promoted for use today…

This speculation is easy to check in the real world. For instance coinsbee is my go-to cards site. It’s more EU focussed.

But their support of BCH is excellent. They instantly notice on their webpage that a transaction is seen etc. They send emails when enough confirmations are seen. But you can also keep the webpage open which updates and unlocks the ‘secret codes’ etc.

So, whatever the reasons for bitrefill is, it is not because it can’t be done. We KNOW it can be. It works for a competitor.

In practice such companies are very often known to actively hate BitcoinCash specifically. As someone that has done a lot of out-reach I know that this is the case. We have a PR problem that stops companies ever looking at things like block times.

it  can be done! no doubt about it, but the UX is different with BCH … the UX you described CANNOT work during an in-person POS, as the wait is indeterminate – whereas the payment options offered by Bitrefill (aside from BTC which is probably just there for decoration) can ALL be fulfilled in less than 2mins (on average)

can be done! no doubt about it, but the UX is different with BCH … the UX you described CANNOT work during an in-person POS, as the wait is indeterminate – whereas the payment options offered by Bitrefill (aside from BTC which is probably just there for decoration) can ALL be fulfilled in less than 2mins (on average)

i certainly DO NOT know why Bitrefill has not implemented BCH, but i’m only pointing out that it’s NOT fair to just assume “hate”, when there are clear “UX challenges” to accommodate with ~10min confs

So I’ve been looking into TailStorm as well, I think that’s the most promising R&D direction because it gives us the benefits of shorter blocks while actually improving orphan rates, wow! And we could go down to 15 seconds sub-blocks rather than 2 minutes!

I failed in explaining my position well. Please allow me to retry:

There is a huge amount of PR issues in BCH. People openly call it a fraud. It is slowly improving, though. We are gaining ground there, which is awesome.

The 10min or sometimes 2 hours blocktime is a separate problem and it is being raised as one that is a root cause of people not adopting BCH. I argue that that conclusion is too simple. Blocktime may be improved, but that won’t really move the needle on adoption or recognition. Just like the dozen other unique features we added over the years on BCH didn’t do much on adoption and price and NOT being labelled a scam.

I think we’ll all have a general agreement on the cost of changing the blocktime.

Where we then differ is that in my assessment the benefit is hugely overstated. Having 2 minute blocks will make people happy that are already accepting of the coin. It will hardly add any new adoptees.

And this statement, I realize as I’m writing this, may look like I’m just making this up. But it is based on knowledge of people and groups. Experience in trying to get people to adopt Bitcoin Cash and running into the problem of “but all crypto is a scam”.

This is a people problem. Not a technical problem.

The core issue is that the majority opinion is that we are to be avoided. This goes for either crypto as a whole, or bch specifically. And I’ve seen this many times as well, especially in the last years with the government pushed ideas, people can start to change their minds for sure.

And when they do, the little details are utterly irrelevant.

More specifically, when the people start to change their minds on crypto and BCH specifically the companies today rejecting it will likely abruptly change their position and start to implement zero-conf. Because it is not only cool, but it sells. It is superiour tech that has a real UX improvement.

And as such my assessment is that the core reason for the lack-luster uptake isn’t blocktimes. The real reason is very different, as described above, and when the real reason is resolved then the blocktime isn’t relevant anymore as what can be made zero conf will be.

What needs confirmations doesn’t have a time-limit (you won’t be waiting for it).

And this last part we already figured out a decade ago when btc wasn’t completely hijacked yet.

Just a very brief note to this, TailStorm introduces a very neat mechanism. We still have our 10 minute summary blocks, but we get 15 second confirmations. Kinda a win-win.

i disagree that the “benefit” has been overstated, at least not by @bitcoincashautist … unfortunately, NGU ppl will always WANT “this” to the panacea that solves all, and so they’ll argue this doesn’t do that … in my view, this has reasonably been presented as “a part” of the solution to improve the BCH UX

i can concede that it’s MORE of a people problem, but there are certainly technical issues (imo being completely ignored); like the current 10-block Checkpoint Consensus that MUST be fixed eventually, right?!

agree!

agree!

some blockchains (L2 w/ VC funding) setup Business Development teams that work around-the-clock to foster relationships with “the real world”, both business and individuals … but they have FUNDING to support them…

imho, BCH will never realize its true potential until there is some consistency and general sustainability of the value-offerings made to its beloved Community – and “The Funding Problem” is allowed to be discussed openly and publicly

(thank you for making such an effort express your opinions so clearly – it’s very much appreciated  )

)

I would encourage everyone in this discussion to look at TailStorm being discussed here: Tailstorm: A Secure and Fair Blockchain for Cash Transactions - #2 by _minisatoshi

All the benefits + more of shorter block times, without the drawbacks.

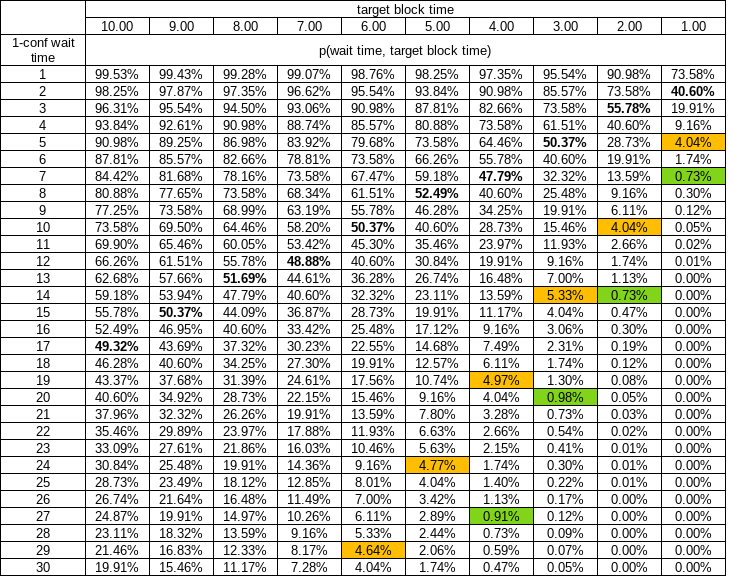

With a random process like PoW mining is, there’s a 14% chance you’ll have to wait more than 2 times the target (Poisson distribution) in order to get that 1-conf.

This is not really correct. It’s much worse than that: 40.6%. Russell O’Connor discusses this here.

The 14% is the probability that the time difference between two blocks is longer than 20 minutes. (The time between blocks has an exponential distribution with rate parameter 1/10 minutes).

That is not the probability that a user waits longer than 20 minutes for their first confirmation. A user is not equally likely to broadcast a transaction during a long block time and a short block time. They are much more likely to broadcast during a long block time because long block times cover longer periods. (We assume that transactions are confirmed in the next mined block and that the timing of a broadcast transaction and the timing of a block being mined are independent.)

The probability distribution of a user’s wait time to first confirmation is an Erlang distribution with shape parameter 2 and rate parameter 1/10 minutes. This is the same as a gamma distribution with shape parameter 2 and rate parameter 1/10 minutes.

This statement is also not correct: “With 2-minute blocks, however, there’d be only a 0.2% chance of having to wait more than 12 minutes for 1-conf!” The correct probability is about 1.7%. You can get this probability by inputting this statement in R: pgamma(12, shape = 2, rate = 1/2, lower.tail = FALSE).

IMHO, O’Connor’s explanation isn’t very detailed, but you can convince yourself that the user’s wait time is an Erlang(2, 1/10) distribution with a simulation. In R it would be:

set.seed(314)

exp_draws <- rexp(1e+07, rate = 1/10)

# Draw ten million block inter-arrival times

user_wait_index <- sample(length(exp_draws), size = 1e+06, replace = TRUE, prob = exp_draws)

# Draw one million indexes from the exp_draws vector. prob = exp_draws means

# that the probability of selecting each index is proportional to the inter-arrival time.

user_waits <- exp_draws[user_wait_index]

# Create the user_waits vector by selecting the appropriate exp_draws elements

prop.table(table(user_waits >= 20))

# The proportion of user_waits that are longer than 20 minutes:

# FALSE TRUE

# 0.593514 0.406486

ks.test(user_waits, pgamma, shape = 2, rate = 1/10)

# Kolmogorov-Smirnov test fails to reject the null hypothesis that the

# user_waits empirical distribution is the same as a gamma(2, 1/10) (i.e. Erlang(2, 1/10))

# Asymptotic one-sample Kolmogorov-Smirnov test

# data: user_waits

# D = 0.00074215, p-value = 0.6404

# alternative hypothesis: two-sided

# Make a histogram of user_waits and compare it to the

# probability density function of gamma(2, 1/10)

hist(user_waits, breaks = 200, probability = TRUE)

lines(seq(0, max(user_waits), by = 0.01),

dgamma(seq(0, max(user_waits), by = 0.01), shape = 2, rate = 1/10),

col = "red")

legend("topright", legend = c("Histogram", "PDF of gamma(2, 1/10)"),

lty = 1, col = c("black", "red"))

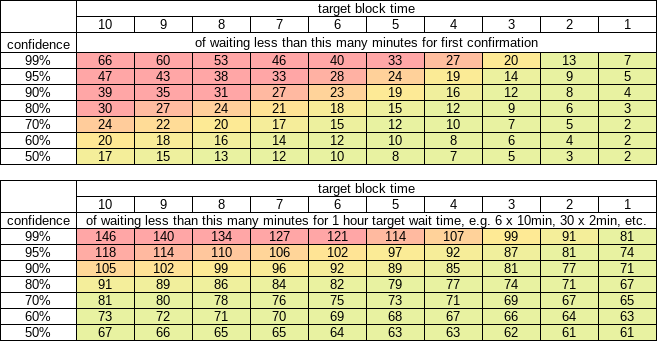

I’m not 100% sure about this, but I think your table also is incorrect. Let x be the number of confirmations and y be the average block time. We use the Erlang distribution again because the shape parameter is the number of events that we are waiting to occur. We add 1 to the shape parameter to factor in the probability that the user broadcasted their transaction during an “unluckily” long block time interval (similar reasoning as before). The distribution of the waiting time would be Erlang(x + 1, 1/y).

When the user is “expecting” a certain number of confirmations in 60 minutes, it would be 6 with the current 10 minute block time and 30 with a 2 minute block time. The distribution of waiting times for a user waiting for 6 blocks with a 10 minute average block time would be Erlang(6 + 1, 1/10). For 30 blocks with a 2 minute block time it would be Erlang(30 + 1, 1/2).

If my conjecture is correct, to fill in the table you would input pgamma(c(70, 80, 90, 100), shape = 6 + 1, rate = 1/10, lower.tail = FALSE) in R for the first column and pgamma(c(70, 80, 90, 100), shape = 30 + 1, rate = 1/2, lower.tail = FALSE). That would give you:

| expected to wait | actually having to wait more than | probability with 10-minute blocks | probability with 2-minute blocks |

|---|---|---|---|

| 60 | 70 | 45.0% | 22.7% |

| 60 | 80 | 31.3% | 6.2% |

| 60 | 90 | 20.7% | 1.2% |

| 60 | 100 | 13.0% | 0.16% |

For reference, I simply used the spreadsheet Poisson function to calculate my numbers:

=1-POISSON(0,time/target_time,0)

Which calculates inverse of observing exactly 0 occurences during the time I expect to see time/target_time occurrences.

Oh I see, my numbers are really numbers of blocks longer than X, but from individual user PoV when he randomly decides to make a TX he can land anywhere between 2 occurrences with duration X between them and because longer durations are well, longer, they take a bigger % of the timeline, so there’s a higher probability of landing in one of the longer ones, and so from user PoV the probability of wait will be different so we need to use Erlang rather than Poisson. Got it. And wow, it’s even worse than I thought.

Thanks for the peer review!

PS I reproduced the above numbers using LibreOffice Calc spreadsheet function GAMMA.DIST:

For the 6-conf wait time >70min probability is: =1-GAMMA.DIST(70, 7, 10, 1) with 10-min blocks.

For 1-conf wait time >20min probability is: =1-GAMMA.DIST(20, 2, 10, 1) with 10-min blocks.

So, Poisson distribution gives us a birds eye view of block times by answering the question: “What % of N block intervals will be longer than X minutes.”

But that’s not answering the question I wanted to ask: “If I make a TX, what are the odds I’ll have to wait more than X minutes for N confirmations.”

As explained above by @Rucknium, the Erlang / gamma distribution answers that.

And it looks like 50% chance of having to wait longer than 17 minutes, and 19.9% chance for longer than 30 minutes, wow! We’d need 6 minute target if we wanted 50% chance of <10min.

Put another way, with 10 minute target you can have only 50% confidence you’ll get that 1 confirmation before 17 minutes passes.

Further and further we go towards why TailStorm is so promising.

Moving my reply here to keep on-topic:

I’ll take the opportunity to share the historical ideas on this.

Zero conf is (and always used to be) secure enough for most. It is a risk level that most merchants will be confident with up until maybe $10000. Heavily dependent on the actual price of a unit and the cost of mining a single block (wrt miner assisted ds).

This is like insurance. Historical losses decide the risk profile. Which means, the better we do with merchants not losing money due to double spends, the higher the limit becomes for safe zero-conf payments.

As such, in a world where Bitcoin Cash is actually used for payments the situation you refer to as “requiring a confirmation or more” tends to be the type that doesn’t really care about block time.

They are the situations where you’re giving your personal details and do a bank transfer. They are the situations where you order it online and it will not be delivered today anyway. These are the situations where, in simple words, the difference between 10 minutes and 2 hours confirmations are completely irrelevant.

I don’t disagree at all about the security of 0-conf. Not one bit. Doesn’t mean that we should completely stay away from improving the confirmation experience to impact real world users and situations for the foreseeable future. Not to mention the other benefits.

Nobody disagrees it would be nice. But the cost is outlandish. Would you buy a $500 pair of jeans for a kid that will outgrow them in a year. What about somene buying a $5000 bicycle just to cover the year until it becomes legal to drive?

This is the disconnect that really gets me…

When do you think any such changes are possible to become used by actual people? A TailStorm will take several years before it can be deployed, another couple before it is used by companies (if ever). Reminder that SegWit usage took 7 years to become the majority used address type.

So, you’re advocating ideas that are intermediary, but can’t possibly be in the hands of users in less than 5 years… See how that is a contradiction?

I’m not stopping you, I’m just realistic about what can be done and what gives the best return on investment.

But it has come to the point that it needs to be clarified that this series of ideas is mostly just harmful for BCH at this point. If it stayed on this site it wouldn’t be harmful, but a premature idea that nobody endorses is being pushed in the main telegram channels daily, is pushed on reddit and on 𝕏. The general public thinks this is happening. While not a single stakeholder is actually buying into this.

Hell, there isn’t even any actual reason given for this shortening that stands up to scrutiny.

That is mostly on @bitcoincashauthist, but you both are not listening to stakeholders and just marching on. Again, if its just here, that’s no problem. It is the going to end-user locations with this that is giving a completely different impression.